The electronic invoice is a document with the same content as a traditional paper invoice, which, however, is presented in digital format and must be signed with a certificate from a recognized certification body.

If we are looking for a specific definition, we can refer to article 1 of Law 56/2007 : "The electronic invoice is an electronic document that meets the legal and regulatory requirements for invoices and that, in addition, guarantees the authenticity of the its origin and the integrity of its content" .

Although there are different mechanisms to guarantee the authenticity of the origin and the integrity of the content from the moment of its issuance until the end of the retention period, in the case of the electronic invoice the use of the electronic signature is the most widespread.

Likewise, Law 25/2013 on the promotion of electronic invoices and creation of the accounting register of invoices in the public sector, in article 5. Format of electronic invoices and their electronic signature, indicates that: ".. .Electronic invoices sent to public administrations must have a structured format and be signed with an advanced electronic signature based on a recognized certificate..."

Electronic invoicing means the process of transmitting invoices between senders and receivers (or similar documents) by electronic means (computer files) and telematics (from one computer to another), digitally signed with recognized certificates and with the same legal validity than invoices issued on paper.

The formats of the electronic invoice can be various (xml, edifact, pdf, html, doc, xls, gif, jpeg or txt, among others) as long as the legal content required for any invoice is respected and the requirements of authenticity are met and integrity, for example with the incorporation of the recognized electronic signature.

However, and after the publication of Order PRE/2971/2007, in which the mandatory use of the xml invoice format was defined when the recipient is the General Administration of the State and its public bodies , this format has also been adopted by other administrations and frequently, among private companies.

It is worth saying that Law 25/2013, in the second Additional Provision indicates: "...electronic invoices sent to public administrations must conform to the structured format of the electronic invoice Facturae, version 3.2" , fixing in this way the format of electronic invoices that public administrations must accept in their invoice register.

On the other hand, it is necessary to bear in mind the Resolution of March 21, 2014, of the Undersecretariat, by which the Resolution of March 10, 2014, of the Secretary of State for Telecommunications and for the Society of the Information from the Secretaries of State of Finance and of Budgets and Expenditures for which a new version, 3.2.1, of the electronic invoice format facturae is published.

What is NOT an electronic invoice?

It is important to know what is an electronic invoice and what is not, as the files we store or send may not be legally valid.

Some examples of documents that are not electronic invoices:

• A digital document in electronic format (pdf, xls, doc, etc.) received by email

• A digital document with a scanned signature

• A digital document signed with a digital certificate not recognized by the AEAT . It must be a recognized certification body

• A digital document signed with a digital certificate expires , given that the certificate is not valid for signing

In short, for an electronic invoice to have the same legal validity as an invoice issued on paper, the electronic document that represents it must carry an advanced electronic signature based on a recognized certificate and be transmitted by telematic means.

The electronic invoice within the overall accounting process should not be understood as part of an isolated process, but as an integrated element within the overall financial management of an organization. Broadly speaking, the electronic invoicing process is made up of two basic and differentiated processes depending on whether it is the issuer or receiver of the invoice.

Requirements for issuing invoices:

- Generation of the invoice from the issuer's management systems or from a market platform providing electronic invoicing services with the receiver's agreement.

- Transformation of the source format of the issuer into the appropriate invoice format.

- Electronic signature of invoices , directly by the issuer or by a third-party platform using a recognized digital certificate.

- Custody of signed invoices or of the original matrix thereof by the issuer or electronic invoicing service provider.

- Access, consultation, viewing, printing, signature audit and download of signed invoices within the issuer's systems (if you decide to keep the signed invoice) or within the third-party platform.

Requirements for receipt of invoices:

- Receipt of invoices in digital format .

- Verification of the e-signature of invoices , either from a local application or through a third-party validation platform.

- Repository and custody of signed invoices in a local application or on a third-party platform.

- Local application or electronic invoicing service providers for access, consultation, viewing, printing, signature audit and download of signed invoices.

In this way, it is no longer required to print the invoice for it to be legally valid and above all, its treatment (issuance, distribution and conservation) can be carried out directly on the electronic file generated by the issuer.

It should also be noted that all the above obligations can be carried out directly by the taxpayer himself or by a third party, acting in the name and on behalf of the first, with whom he must have the corresponding agreement for the provision of services (regulated in the article 5.1 of RD 1496/2003 , where the legislator makes it clear that even if sub-invoicing to third parties is allowed, the taxpayer is responsible for fulfilling all these obligations).

Content of invoices.

The Royal Decree 1619/2012, of November 30, which approves the Regulation regulating invoicing obligations, in its chapter II, invoice requirements, in article 6 refers to the content of the invoice in the following terms:

"1. Every invoice and its copies must contain the data or requirements specified below, without prejudice to those that may be mandatory for other purposes and the possibility of including any other mentions:

a) Number and, if applicable, series...

b) The date of dispatch.

c) First and last name, name or full company name, both of the person obliged to issue an invoice and of the recipient of the operations.

d) Fiscal identification number...

e) Domicile, both of the person obliged to issue an invoice and of the recipient of the operations.

f) Description of the operations, including all the data necessary to determine the taxable base of the tax...

g) The tax rate or tax rates, if applicable, applied to the operations .

h) The tax quota that, if applicable, is repercussed, which must be recorded separately.

i) The date on which the documented operations were carried out or on which, if applicable, the advance payment was received, as long as it is a different date than the invoice issue date.

j) In the event that the transaction documented in an invoice is exempt from tax, a reference to the corresponding provisions of Directive 2006/112/EC , of November 28, relating to the common tax system on the added value, or to the corresponding precepts of the Tax Law or indication that the operation is exempt..."

Preservation of the electronic invoice.

The receiver of the electronic invoice must keep it as it has been transmitted to him , in an electromagnetic or optical medium and must have computerized means that allow him to verify its authenticity and integrity.

The electronic invoice format defined by the General Administration of the State and implemented in the e-FACT service of the AOC Consortium is an XML with a specific structure known as bill it

Currently, the versions of Facturae accepted by the e-FACT service, in accordance with the Law 25/2013, of December 27, promoting electronic invoicing and creating the accounting register of invoices in the Public Sector , are 3.2, 3.2.1 and 3.2.2.

If invoices are sent in an older format, they will be rejected.

You can get more detail of the format outline and versions in the document Website Invoice Format http://www.facturae.es .

Yes . The Generalitat de Catalunya has declared the e-FACT service as the General Point of Entry of Invoices for the Catalan Public Administrations through agreement 151/2014, of November 11, on the general point of entry of electronic invoices in Catalonia, published in DOGC no. 6747, of November 13, 2014.

Documents of interest:

Agreement 151/2014, of 11 November, on the general entry point for electronic invoices in Catalonia

- Yes , the e-FACT complies with the requirements of Order HAP/1074/2014, of 24 June , which regulates the technical and functional conditions that must be met by the general entry point for electronic invoices. In this way:

- The protocol used by the AOC Consortium (FTP / SFTP) for the automatic sending of electronic invoices from the supplier's invoice management systems perfectly complies with the definition of international organizations (W3C) on web service interfaces. Web services are a set of protocols and standards that aim to exchange data between applications, although many others are recognized among the main ones, SOAP.

- In relation to the requirement of Order HAP/1074/2014 that the communications between the supplier's system and the service be signed by a certificate owned by the supplier or owned by a third party other than the supplier with which the billing service has been contracted electronic, the e-FACT service allows the use of the SFTP protocol that incorporates the use of cryptography, with a public key system to provide security and confidentiality to transfers.

- The technical conditions of "the resolution of October 10, 2014, of the Secretaría de Estado de Administraciones Públicas" only apply to the general point of entry of electronic invoices of the General Administration of the State, as it says point 1) of the resolution and therefore does not affect the e-FACT.

Goal

Incorporate the necessary adaptations to the General Point of Invoice Entry (PGE, hereafter) of the e-FACT service to comply with the requirements required of PGEs as established by Order HAP/1650/2015, of July 31, by which Order HAP/492/2014, of March 27, which regulates the functional and technical requirements of the accounting register of invoices of entities within the scope of application of Law 25/2013, of 27 of December, promoting electronic invoicing and creating the accounting register of invoices in the public sector, and Order HAP/1074/2014, of 24 June, which regulates the technical and functional conditions that must meet the general entry point for electronic invoices : https://www.boe.es/diario_boe/txt.php?id=BOE-A-2015-8844

Description of the validation rules

In the document you will find who is responsible for making the validations (e-FACT as PGE or the invoice accounting records (RCF) of the entity receiving the invoice).

Recommendations regarding the order in which to apply the validations

- It is recommended to follow the sequence

- It is recommended to carry out all validations to return to the supplier all detected errors, except for the following:

- If you do not pass the 6th validation regarding the number of decimal places, you do not continue with the 6th validation regarding the calculation of the total cost and gross amount.

- If validation 6b regarding the number of decimal places is not passed, validation is not continued

E-invoice format recommendations 3.2.1 for the application of these validations

Given that the accounting validations in section 6 of the order involve calculations of amounts, we recommend sending invoices in format 3.2.1 for greater accuracy in the case of amounts with fractions and thus avoid rejections due to incorrect rounding required by the e-invoice format 3.2.

How are the RCF rejects returned to the PGE?

When an invoice is rejected for not complying with the validation rules, all these errors have been grouped under code =HF09 and the specific code of the error and its description are included in the description. All detected errors are returned in the following format:

- "Error code: Description | error code: Description"

For example in an invoice with detected validation errors RCF05002 and RCF05004 would be returned as a rejection comment:

- RCF05002: Issuer: The NIF does not conform to the rules and criteria of its formation. Rule number 5b of Annex II of Order HAP / 1650/2015 is breached | RCF05004: Issuer: First name and last name are required. Rule number 5d of Annex II of Order HAP / 1650/2015 is breached |

Note that the size of this field is 500 characters and if the sum of errors exceeds this threshold, the error message will be truncated when character 500 is reached.

Description of validation errors

| Code | Error description | Implementation date in the PGE |

| RCF03001 | The invoice number is mandatory. Rule 3a of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF04001 | Rectifying invoice with rectification criteria other than 01,02,03,04. Rule 4a of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF04002 | For rectification invoices with rectification criteria 01 or 02, the invoice number of the issuing issuer is mandatory. Rule 4b of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05001 | Issuer: The code of type of person, physical \"F\" or legal entity \"J\" is mandatory. Rule 5a of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05002 | Issuer: The NIF does not conform to the rules and criteria of its formation. Rule 5b of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05003 | Issuer: The country code (two first characters of the NIF when they are letters) when it exists, will be adjusted to what is established in the Invoice scheme itself. Rule 5c of Annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05004 | Issuer: Number and first name are mandatory. Rule 5d of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05005 | Issuer: The company name is mandatory. Rule 5e of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05006 | Transferee: The code of type of person, physical \"F\" or legal entity \"J\" is mandatory. Rule 5a of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05007 | Assignee: The NIF does not conform to the rules and criteria of its formation. Rule 5b of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05008 | Assignee: The country code (two first characters of the NIF when they are letters) when it exists, will be adjusted to what is established in the Invoice scheme itself. Rule 5c of Annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05009 | Transferee: The number and first name are mandatory. Rule 5d of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF05010 | Assignee: The company name is mandatory. Rule 5e of annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF06001 | In the invoices issued in euros, some of the line amounts have more than two decimal places or are not numeric. Rule 6a of Annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF06002 | In invoices issued in euros, the total cost of each line must be equal to the product of the number of units by the unit price rounded with the common method of rounding to two decimal places. Rule 6a of Annex II of Order HAP/1650/2015 is not complied with | From 05/03/2017 |

| RCF06003 | In invoices issued in euros, the gross amount of each line must be the sum of the total cost plus the sum of surcharges minus the sum of discounts. Rule 6a of Annex II of Order HAP/1650/2015 is not complied with | From 05/03/2017 |

| RCF06004 | In the invoices issued in euros, some of the amounts at the invoice level, except the tax rates or the percentages to be applied, have more than two decimal places or are not numerical. Rule 6b of annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF06005 | In invoices issued in euros, the total gross amount of the invoice must be the sum of the gross amounts of the lines. Rule 6b of annex II of Order HAP/1650/2015 is not complied with | From 05/03/2017 |

| RCF06006 | The currency code is not valid. The rule is broken. Rule 6c of Annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF07002 | The date of issue of the invoice is mandatory and must be a valid date. Rule 7a of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF09002 | There are invoice lines without content in the description. Rule 9b of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF01001 | The invoice does not comply with the "Facturae" XSD schema of the corresponding version (3.2 or 3.2.1). Rule 1 of annex II of Order HAP/1650/2015 has been breached | 15/03/2017 |

| RCF02001 | Invalid signature: Certificate currently expired in a non-long-lived signature. Rule 2 of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF02002 | Invalid signature: Certificate currently revoked in a non-long-lived signature. Rule 2 of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF02003 | Invalid signature: Invalid certificate. Rule 2 of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF02004 | Invalid signature: Untrusted certificate. Rule 2 of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF02005 | Invalid signature: Integrity error. Rule 2 of annex II of Order HAP/1650/2015 is not complied with | 15/03/2017 |

| RCF02006 | Invalid signature: Invalid signature format. Rule 2 of annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF02010 | The invoice does not contain signatures: Rule 2 of Annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF09001 | The registration number assigned at the general entry point for electronic invoices is mandatory. Rule 9a of Annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

| RCF07001 | The date of entry in the administrative register is mandatory, it must be valid, prior to or equal to the current date and greater than or equal to the date of issue of the invoice. Rule 7a of annex II of Order HAP/1650/2015 is not complied with | 03/15/2017 |

The administration that wishes to use the e-FACT service must perform the following actions:

- Accept the receipt of invoices in electronic format through the e-FACT service for any supplier company by accepting the terms of service .

- Fill in the corresponding service registration form , where the access methods and the selected functionalities will be specified.

- Publish a link to your electronic headquarters of the e-FACT service invoice delivery mailbox , or provide an equivalent mechanism that ensures that any supplier company can send invoices to the receiving body in electronic format at no cost.

- Comply with the following legal obligation :

- Entry registration of electronic invoices

- Report on the processing statuses of invoice management and entry registration data through the status information system.

1. Registration

The receiving body instructs the AOC Consortium, the automatic registration of invoices in the body's own register, which has been duly integrated into the unified registration service (MUX) of the AOC Consortium, or in the auxiliary electronic register of receiver enabled in EACAT by default.

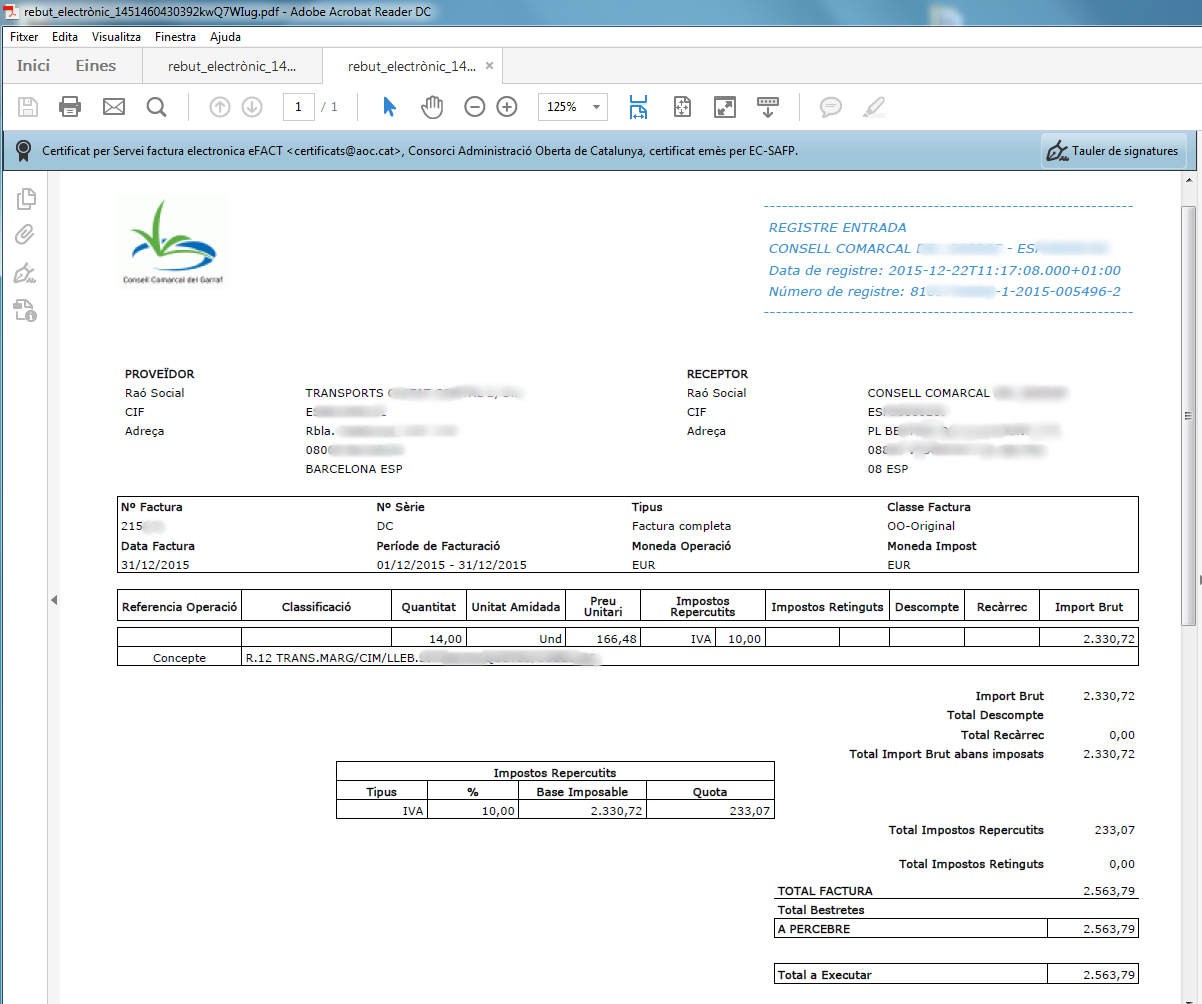

Note that as a result of registration, the e-FACT service generates an electronic receipt . The receipt, which consists of a copy of the invoice in pdf format signed electronically, will be given to both administrations and companies, being in this case the guarantee of presentation of the invoice to the recipient.

Below is an example of an electronic receipt issued by the e-FACT service with viewing using Adobe Reader.

The updated information on the electronic invoice can be found at:www.facturae.es

This portal dedicated to electronic invoicing contains a specific section of legislative collection.

Below we highlight the most relevant legal documents and identify the key aspects that directly affect the electronic invoice:

- The Council of Ministers, at the proposal of the Ministries of Economy and Finance and Industry, Commerce and Tourism, will adopt the necessary measures to facilitate the issuance of electronic invoices for people and entities that contract with the state public sector

- The free support services established for companies in an Order issued by the Ministry of Economy and Finance must be guaranteed

Royal Decree 1619/2012, of November 30, approving the Regulation regulating invoicing obligations

- The same applies to paper invoicing and electronic invoicing . This equality expands the possibilities for the taxable person to be able to issue invoices electronically without the need for it to be subject to a certain technology

- However, to guarantee the legal security of taxable persons who were already using data interchange (EDI) and advanced electronic signatures, the Regulation expressly recognizes that these technologies, which are no longer mandatory, guarantee the authenticity of the origin and the integrity of the content of the electronic invoice. Likewise, taxable persons may continue to communicate to the State Tax Administration Agency, prior to their use, the means they consider to guarantee the conditions mentioned so that they are validated by the same, if applicable.

- Possibility of electronic submission of invoices or substitute documents and copies of these with an electronic signature recognized by means of a digital certificate

- Possibility of using electronic invoicing systems based on electronic data interchange (EDI) agreements

- Possibility of receiving electronic invoices from third countries with the same conditions as those required in Spanish territory

- Authorization of electronic invoicing systems at the request of the taxpayer

- The use of electronic means for sending electronic invoices to AAPPs is subject to their express consent. Consent is general and will be extended to all cases in which you are the recipient of invoices

- Remittance of electronic invoices intended for, or presented to, the AGE or its linked or dependent public bodies, including both in the field of administrative contracting and those issued between individuals, and in the course of any administrative procedure

- The electronic invoices issued by the AAPP will meet the same conditions as those intended for them

- Electronic invoice standard format (XAdES)

- Boosting the bill in the public and private sector

- More protection for suppliers in their commercial relations with public administrations, given that invoices are presented in an accounting register

- Single invoice entry point for each administration (State, Autonomous Communities and Local Entities) where all invoices from entities, organizations and bodies linked or dependent on that administration will be received

- The invoices will have a structured format to be specified in a Ministerial Order and signed electronically with a signature based on a recognized digital certificate

- Obligation to present electronic invoices to all subjects obliged to pay electronic taxation in accordance with the tax regulations from January 15, 2015. However, the administrations may by regulation exclude invoices with an amount of less than five thousand euros from this obligation

- All public administrations will have the obligation to have an accounting register of invoices managed by the body entrusted with accounting management

Order HAP/1650/2015, of July 31, which modifies Order HAP/492/2014 , of March 27, which regulates the functional and technical requirements of the accounting register of invoices of entities of the scope of application of Law 25/2013, of December 27, on the promotion of electronic invoicing and creation of the accounting register of invoices in the public sector, and Order HAP/1074/2014 , of 24 June, which regulates the technical and functional conditions that must be met by the general entry point for electronic invoices.

- Obligation to submit invoices in an administrative register and identification of bodies

At the Catalan level, the regulations are available which are listed below.

Law 29/2010, of August 3, on the use of electronic media in the public sector of Catalonia , establishes in its sixth final provision the use of electronic invoices in the following terms:

- The Government of the Generalitat must promote the use of electronic invoicing among economic actors in Catalonia

- The Generalitat must collaborate with the General Administration of the State in promoting the use of electronic invoices

- The entities that make up the public sector of Catalonia must guarantee the acceptance of electronic invoices within six months of the entry into force of this law and must promote its extension among their suppliers

Law 10/2011, of December 29, on the simplification and improvement of the regulatory framework , defines in the Fourth Additional Provision for the promotion of electronic invoicing:

- With the aim of making fully effective the determinations of Law 29/2010, of August 3, on the use of electronic media in the public sector of Catalonia, the entities of the public sector of Catalonia must promote the use of electronic invoice as a condition of execution of public sector contracts

- Establishes that the e-FACT service of the Consorci d'Administración Oberta de Catalunya is the general entry point for electronic invoices of the Autonomous Community of Catalonia, in accordance with article 6.1 of Law 25/2013, of 27 December, promotion of the electronic invoice and creation of the accounting register of invoices.

Source: Electronic invoice guide , Generalitat de Catalunya and General Council of Chambers of Catalonia

- Collection of state regulations: http://www.facturae.gob.es/factura-electronica/Paginas/repertorio-legislativo.aspx

- Collection of regional regulations: http://dogc.gencat.cat/ca/pdogc_canals_interns/pdogc_resultats_fitxa/?documentId=674751&action=fitxa

- Collection of state, regional and European regulations: http://bit.ly/guiaefactura (ANNEX. Legal framework for electronic invoices)

- Facturae portal: http://www.facturae.gob.es

- Free platforms to send eInvoices to AAPPs: pimefactura , b2brouter

- AEAT information website on electronic invoicing: FAQs on electronic invoicing